Where to start Crypto Farming (part 2)

This is the second part of a series of articles around Crypto Farming, if you are not familiar with terms like liquidity pools, farming or IL I recommend you to read this first:

Now, let’s start with the first place where all of this defi hype started, eth and uniswap!!

I’m going to use a Metamask wallet so I assume you know how to use it, but if that’s not the case and you would like a tutorial please feel free to add a comment here :)

Uniswap liquidity pools

If you are in the defi hype you would realise most of the early gems are listing first on Uniswap, so let’s say you want to buy Orion, you would use next url:

You may have next questions:

- how is price determined?

- why projects are choosing Uniswap?

To answer the first question we need to come back to our previous article, where we showed how to add liquidity to the pool

Then, the first person who add liquidity to a pool chose a concrete amount of two tokens, and this rate is what marks the initial price

Example, Orion team and want to list on Uniswap with next parameters:

- Initial price 15 $usdc per Orion (1:15)

- Initial liquidity: 1K Orion → then they need to add 15K $usdc to keep ratio

Steps to follow:

- chose pool option on Uniswap and click “Create a pair”

- chose the pair we want to create and the number of tokens

And that’s it… we listed on Uniswap a new token pair orn:usdc with an initial price of 1 orion : 15 usdc

So, everybody can list on Uniswap? Yes

And it’s free? Exactly

Now we come into the liquidity problem, if we run out of one of the tokens in the pool, the price will move a higher % (we will say it has high volatility), let me show you in pictures:

- liquidity is 3:3 so current price = 1 ETH/Orion

- one user buy 1 Orion with 1 eth, what is the price impact?

- after previous swap the pool has 4 ETH and 2 Orion so

new price = 2 ETH/Orion

Price impact 200% !!!

- now we start with double liquidity 6 orion : 6 eth, same price 1 ETH/Orion

- what is the impact with the same swap now?

- now we have 5 Orion : 7 ETH so

the new price is 1.4 ETH per Orion

40% price impact (previous example was 200%)

Conclusion:

The higher the liquidity the lower the volatility

Less volatility provides more stability to the project

To improve the liquidity one of the most use solution is to create a liquidity farming program, so now the question is…

How can you farm your favourite token?

First you need to find a project that has a liquidity program, then you need to follow next steps (let’s continue with Orion Protocol):

- go to the farming website

- check which liquidity pools are available (on this case orn - eth)

- check where you have to add liquidity (on this example Uniswap)

- click on “add liquidity” button from previous screen and supply liquidity:

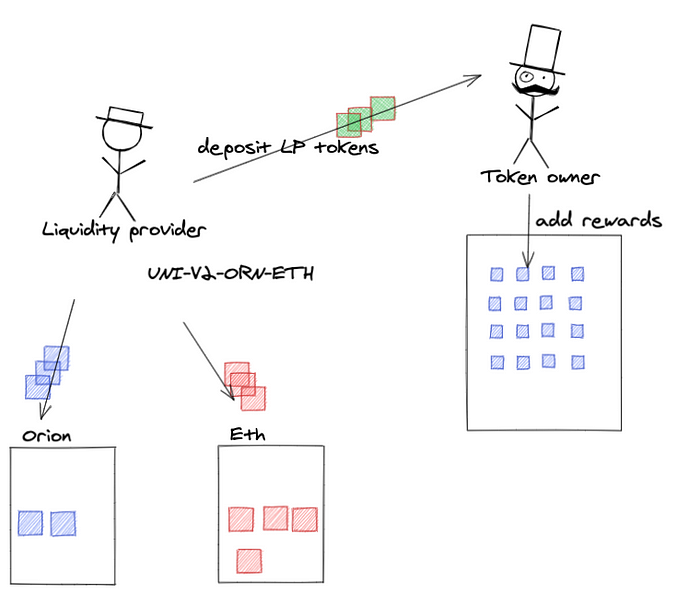

- when you do that you will see your balance of Orn and ETH decreases and in exchange you get a new token “UNI-V2-ORN-ETH” that represents your share in the pool

The token UNI-V2-ORN-ETH represents your shares on the pool and is like a contract that allows you to benefit from the fees generated by swaps

- the next step is to stake LP tokens into the farming program

- Now you can claim your rewards at any time, you will get more based on:

how long you waited since last claim

how big % you have put on the LP

And that’s the end of this article, on the next one I want to cover the basic numbers you need to consider in order to maximize your returns!

Next article, how to manage your rewards: